You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?

Here are a few quick FAQs that can help you decide how much you should prioritize staging as you prep for your move.

What Is Home Staging?

Staging is the process of arranging and decorating your house to highlight its best features and make it as appealing as possible to potential buyers. It can range from simple touch-ups to more extensive setups, depending on your needs and budget.

How Does It Help Me Sell My House?

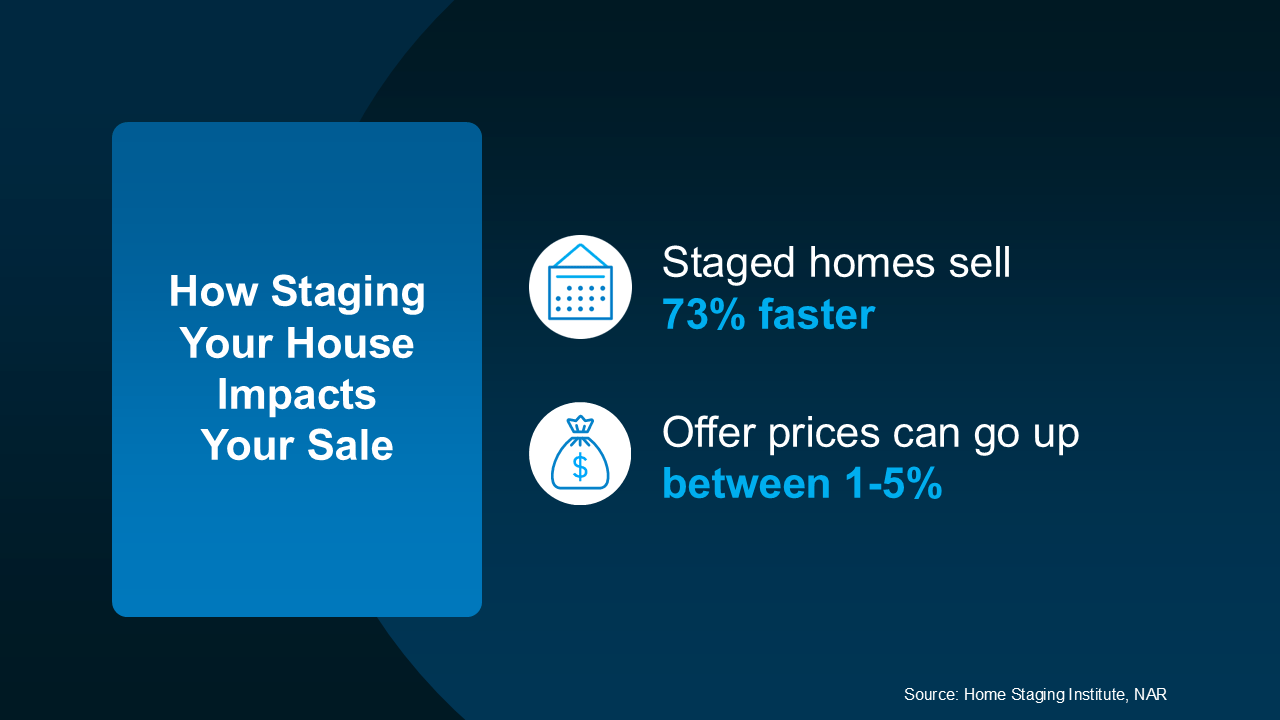

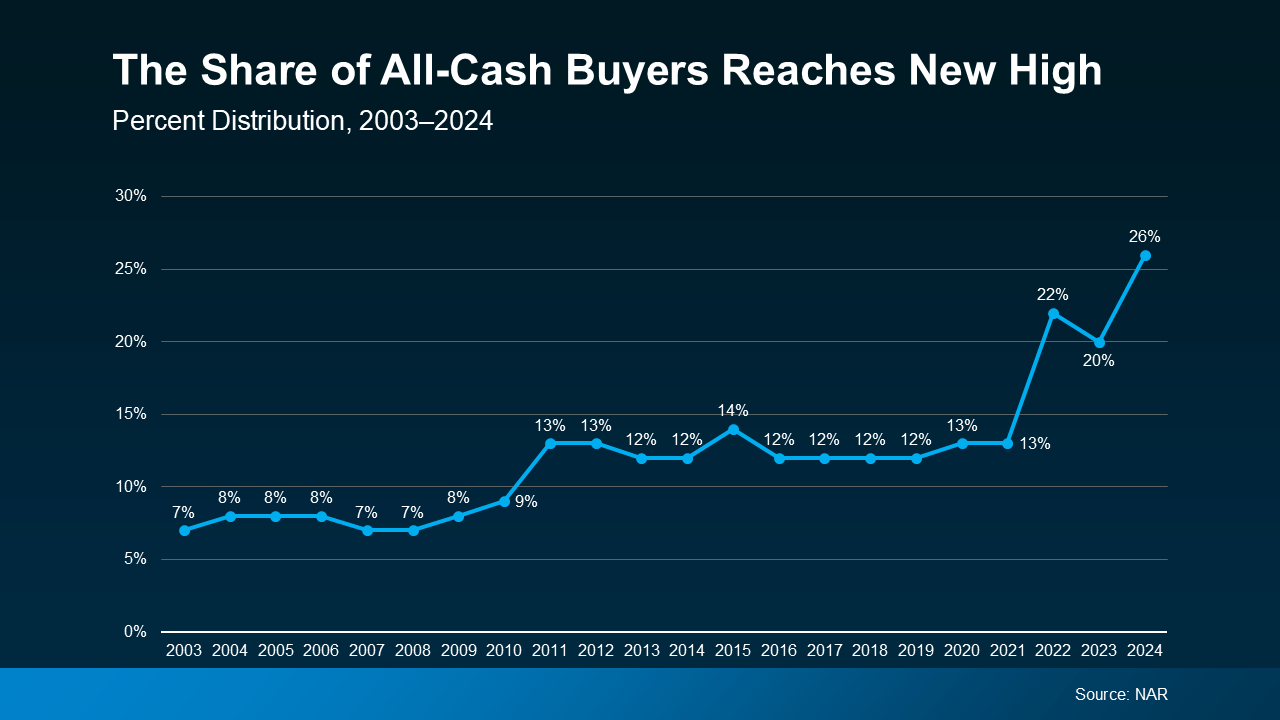

Studies show good staging does have an impact on your sale. Staging your house well can help you attract more attention from buyers, which ultimately helps it sell faster and maybe for a higher price than an unstaged home (see visual):

What Are My Staging Options?

Now that you see the value, let’s think through your options. The most common is leaning on your agent for their expert advice. They know what buyers like because they’re in showings all the time and hear that feedback first-hand. That expertise is crucial to getting your house market-ready. Basic staging with an agent usually means they give you insight into how you should:

- Declutter and depersonalize by removing photos and personal items

- Arrange your furniture to improve the room’s flow and make it feel bigger

- Add plants, move art, or re-arrange other accessories

Full-service staging is another option if your house needs more hands-on attention. This is when you hire a staging professional or staging company to come in, make recommendations, and do the work for you. Going this route is more involved and that makes it more costly too. That’s because it can include renting furniture and decor to more fully transform a space.

How Do I Know Which One To Pick?

Not sure which one you need? You don’t have to figure that out on your own. Your real estate agent will help determine what level of staging will make the most impact on your house and market.

They can help you decide if professional staging is worth the investment, or if you can knock it out with their advice alone. And just so you know, here are some of the factors an agent will look at to figure that out:

- Market Conditions: If the market is slower, going all in on staging can make your home look move-in ready and attractive to buyers who may otherwise be hesitant. If your local market is very active and homes are selling fast, you may be able to get by with doing less.

- Your Home’s Condition: If your home is vacant or has a unique layout, using a professional stager who can bring in the right furniture and accessories may help buyers truly visualize its full potential.

- Your Budget: Talk to your agent to get an idea of staging costs in your area, as it can be the difference between your house selling and sitting. But if your budget is tight or your home only needs minor updates, your real estate agent can help you think outside of the box by suggesting simple DIY staging tips to help your home look its best.

Bottom Line

Staging your house properly can make it much more attractive to buyers, but it’s not a one-size-fits-all solution, and every home shines differently. Let’s connect to talk through what your home really needs to stand out and sell for top dollar.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link